India has been witnessing a spike in demand for instant personal loans. Recent data suggests that the disbursal volume and value of personal loans rose by 3.8 times and 2.3 times, respectively, for a period ranging from FY17-21. Moreover, the overall portfolio of personal loans has witnessed a growth of 20% Y-o-Y (year on year) as of March 2021. Loan applicants are more eager to take loans through digital apps because of the straightforward process and quick disbursal. Several online loan apps have enhanced the simplicity of the loan process, making the experience hassle-free for applicants.

Top 6 best instant personal loan apps

Multiple instant personal loan apps are available to address immediate liquidity requirements. Applying for a loan through an app requires minimal effort and is a fast, hassle-free, and paperless way of getting instant funds. Let us look at India’s top instant personal loan apps and their outstanding features.

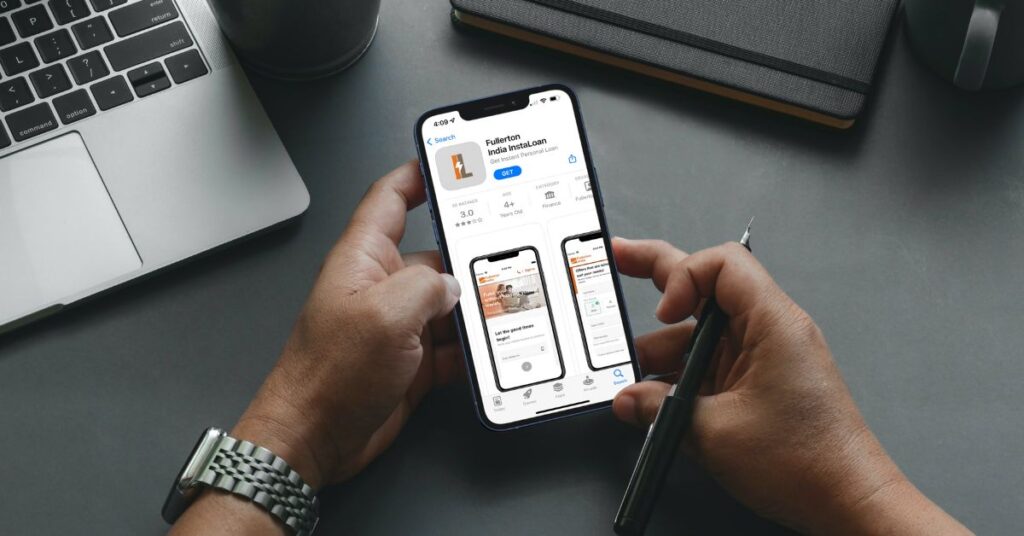

1. Fullerton India Instaloan

The Fullerton India Instaloan app tops the charts by offering unparalleled services at your fingertips. Applicants can now avail of a loan by making an online application through the instaloan app, tracking the loan application status, filling out the necessary details, and uploading the required documents.

Fullerton India Instaloan app offers loan amounts up to Rs. 25 Lakhs at flexible interest rates starting at 11.99% up to a maximum limit of 36% and tenures ranging from 12 to 60 months. The app requires minimal documentation and provides quick loan disbursal. After processing the loan application, the funds get disbursed to the applicant’s accounts within 24 hours. The app can be used to check loan eligibility, apply for a loan in a few simple steps, access loan details, and much more. The app is compatible with both iOS and Android.

2. Bajaj Finserv app

The Bajaj Finserv app comes with a user-friendly interface and manages diverse requirements from applying for personal loans to paying bills, buying insurance, shopping for the latest electronics, and much more. The app offers loans for professionals and self-employed individuals at affordable interest rates ranging from 12% to 34%, a nominal processing fee of Rs. 500 to Rs. 2000, and minimal documentation.

3. Tata Capital app

Tata Capital mobile app offers personal loans to meet diverse needs such as education, travel, and medical emergencies. Applicants must share their PAN card and income details to get instant loan approval using the app. The app offers numerous features, such as less documentation and higher loan eligibility. Applicants are not required to submit any collateral, guarantee, or security while applying for a loan. The app provides assistance through TIA, powered by an AI voice bot to assist you with your personal loan application.

4. Stashfin

Stashfin, powered by Akara Capital Advisors Private Limited, offers instant funds for personal loan applicants. The app offers loans ranging from Rs. 1,000 to Rs. 5,00,000 straight to the applicant’s account. It provides a quick and easy application process with low-interest rates and flexible repayment plans designed to suit diverse customer requirements. The app charges low processing fees and no hidden charges. All loans through Stashfin are paid through EMIs through digital mode.

5. Kreditbee

Kreditbee offers online personal loans anytime, anywhere, ranging from Rs. 1,000 to Rs. 3,00,000. The app provides various features, such as low paperwork, flexible interest rates and tenures, and low processing fees for applicants to get instant credit in their accounts within minutes.

6. Navi app

Navi Finserv Limited has launched the Navi app, offering applicants instant personal loans up to Rs. 20 Lakhs. You can use the app to check for loan eligibility, complete your video KYC using your PAN and Adhaar card, add bank details, set auto pay and get instant cash in your account. The app follows a 100% digital process for loan disbursal and offers a flexible repayment tenure.

Conclusion

There are numerous platforms available to apply for an instant personal loan. Before applying, applicants must carefully research all the features of the online loan app and look for attractive interest rates and suitable repayment tenures. In addition, applicants must analyze the eligibility requirements, ease of documentation process, freedom of usage of the loan amount, application interface, third-party integrations, and customer service before selecting a lender. Instant loan personal apps provide immense flexibility in documentation and turnaround time, making the experience smooth for loan applicants.

Additional Read: Top 5 Fashion Trends for Women Over 40